Here are the key points :

1.Prices for goods and services, excluding food and energy, went up by 2.8% compared to last year in March, which was the same as February and slightly higher than predicted.

2.People spent 0.8% more in March, while their incomes only increased by 0.5%.

3.The savings rate dropped to 3.2%, which is 0.4 percentage points lower than February and 2 full percentage points lower than a year ago.

In March, inflation continued to stay strong, with a key measure closely monitored by the Federal Reserve indicating that prices are still higher. The price index for personal consumption, excluding food and energy, rose by 2.8% compared to last year, matching February’s increase. This was higher than the expected 2.7% as per the Dow Jones consensus.

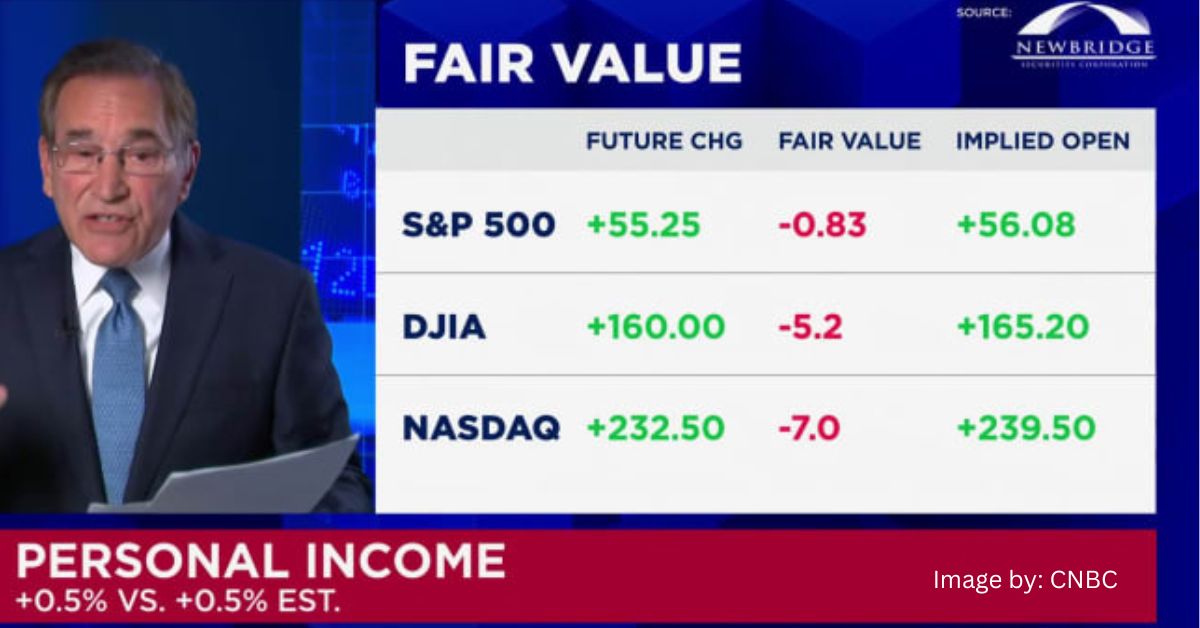

The overall prices, including food and energy, went up by 2.7%, slightly higher than expected. Monthly prices increased by 0.3%, the same as the previous month. The stock market didn’t react much to this news and is expected to open higher. However, Treasury yields fell, meaning the return on the 10-year government bond decreased. Traders now think there might be two interest rate cuts this year with a 44% chance according to the CME Group’s FedWatch gauge.

The inflation reports released this morning were not as bad as many had feared. While some may think inflation has been completely controlled and that the Federal Reserve will cut interest rates soon, investors should not get too fixated on that idea. According to George Mateyo, the chief investment officer at Key Wealth, rate cuts are still possible, but they are not guaranteed. The Fed is likely to wait for signs of weakness in the job market before making any interest rate cuts.

Despite the higher prices, consumers are still spending money. Personal spending went up by 0.8% this month, slightly higher than the expected 0.7% and the same as February. Personal income also rose by 0.5%, matching expectations and showing an improvement compared to the 0.3% increase seen the previous month.

The recent report shows that the personal saving rate has dropped to 3.2%, decreasing by 0.4 percentage points from February and 2 full percentage points from a year ago. This decline suggests that households are using their savings to sustain their spending.

Additionally, recent inflation data has been negative, with the Personal Consumption Expenditure (PCE) in the first quarter rising at a 3.4% annualized rate, while the gross domestic product (GDP) increased only by 1.6%, falling short of expectations.

As inflation continues to be a concern, the Federal Reserve (Fed) is closely monitoring the situation, and is likely to maintain current interest rates at least until summer unless there are significant changes in the economic data.

The Fed aims for 2% inflation, but the core PCE has been above this target for the past three years. This situation puts pressure on policymakers to carefully consider their next steps in monetary policy.

The Federal Reserve closely monitors the Personal Consumption Expenditures (PCE) index because it offers a more accurate reflection of changes in consumer spending tendencies. Unlike the Consumer Price Index (CPI) released by the Labor Department, the PCE index places less emphasis on housing costs.

Within the PCE index, the Fed pays attention to both headline figures and core measures, with more focus on the index excluding food and energy. This is because food and energy prices can vary significantly in the short term, whereas excluding them provides a clearer picture of long-term trends.

In recent data, service prices rose by 0.4% while goods prices increased by 0.1%. This shift indicates a change in consumer spending patterns, as goods inflation had been more prominent since the start of the Covid-19 pandemic. Food prices experienced a slight decline of 0.1% for the month, while energy prices went up by 1.2%.

In the past twelve months, the prices of services have gone up by 4%, while the prices of goods have only increased by 0.1%. Specifically, food prices have risen by 1.5%, and energy prices have seen a 2.6% increase.